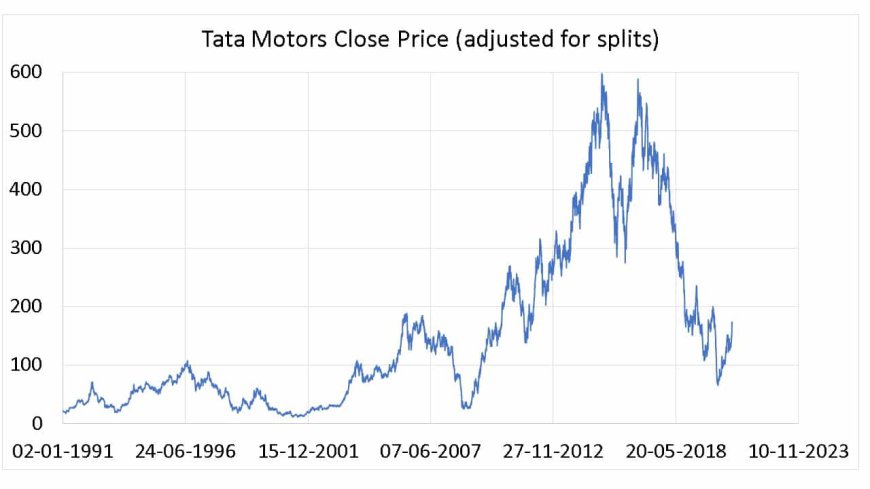

The inventory marketplace is a dynamic area wherein charges can differ unexpectedly, responding to different factors consisting of economic information, organization's overall performance, and worldwide occasions. In a state-of-the-art live update, we take a more in-depth look at Tata Motors, considered one of India's leading automobile producers, and its recent stock performance. Join us as we delve into the factors influencing Tata Motors' proportion charge nowadays.

Tata Motors Inside the Limelight

Tata Motors, a subsidiary of the Tata Group, is understood for its various range of automobiles, such as passenger automobiles, commercial cars, and electric-powered vehicles. The enterprise's inventory overall performance frequently garners interest in the financial markets because of its vast position within the car industry.

Live Market Updates

As of the modern-day market statistics, Tata Motors' proportion rate has experienced a decline. Stock costs can differ for numerous reasons, including market sentiment, organization bulletins, and economic indicators. Here are a few capacity elements contributing to the recent stock's overall performance:

1. Market Sentiment: Stock markets are motivated by using investor sentiment, which can be exchanged swiftly primarily based on news and occasions. Negative sentiment, even though unrelated to Tata Motors especially, can affect stock expenses.

2. Economic Factors: Economic signs, consisting of GDP boom, inflation rates, and consumer self-assurance, can have an effect on stock expenses. A weakening economic system can lead to reduced customer spending on vehicles.

3. Company Performance: Tata Motors' financial performance, which includes revenue, profitability, and car sales, plays a crucial function in determining its inventory charge. Any considerable information associated with an employer's overall performance can affect proportion expenses.

Also see: Tech News Updates:

The Visionaries Behind Human-AI Robot Creation

4. Global Events: Global occasions, inclusive of modifications in exchange guidelines, geopolitical tensions, or disruptions within the delivery chain, can impact the car industry and, therefore, Tata Motor' stock price.

5. Electric Vehicle (EV) Developments: As the world shifts closer to electric-powered cars, tendencies in Tata Motors' EV segment can have an effect on investor notions and share prices.

Investor Outlook

Investors regularly rely upon a combination of technical and essential evaluations to make selections concerning Tata Motor and other shares. It's vital to take into account that inventory costs can be risky, and short-term fluctuations are commonplace. Long-time period investors may additionally remember factors just as the employer's increased potentialities, marketplace role, and enterprise tendencies when making funding selections.

Conclusion

The stock market is a dynamic environment wherein expenses can be traded unexpectedly based on a large number of things. Tata Motors, as an outstanding participant in the automobile industry, is subject to market dynamics and employer-particular events that could impact its percentage rate. Investors and market observers have to stay knowledgeable about trends in the automotive sector and broader financial tendencies to gain insights into Tata Motors' inventory overall performance nowadays and in the future.

Also see: Education News India

Follows Us for More Updates

Like Us on our Facebook Page: Click Here

Like Us on Instagram: Click Here