How to Teach Kids About Money: Easy Financial Tips for Parents

Teach kids about money and financial literacy early with practical tips on saving, budgeting, and smart spending for lifelong financial success.

Financial literacy is a crucial life skill that every child should learn from an early age. Teaching kids about money not only helps them understand the value of earning and saving but also prepares them for financial independence. With digital transactions becoming more common, it is essential for children to grasp basic money management concepts early on. Here’s how parents and educators can introduce financial literacy in a simple and engaging way.

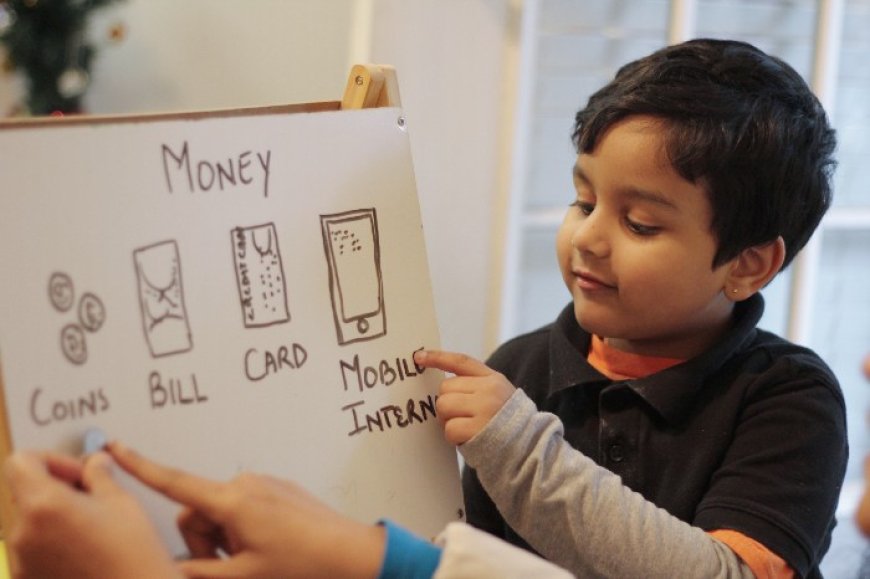

1. Start with the Basics: Understanding Money

Begin by explaining the concept of money to children. Show them different coins and currency notes, and teach them their values. Let them observe how money is exchanged for goods and services. This foundation will help them recognize the importance of earning and spending wisely.

2. Teach the Difference Between Needs and Wants

One of the key financial lessons is distinguishing between needs and wants. Explain that needs are essential items like food, clothing, and shelter, whereas wants are things they desire but can live without. Use real-life examples to help them make mindful spending decisions.

3. Introduce the Concept of Saving

Encourage kids to save a portion of their pocket money or gift money in a piggy bank or savings jar. Explain that saving allows them to buy something special in the future rather than spending all their money at once. This helps build patience and financial discipline.

4. Set Up a Simple Allowance System

Giving children a weekly or monthly allowance teaches them how to manage their own money. Guide them to divide their allowance into three categories: saving, spending, and sharing. This method helps them understand budgeting and financial planning from an early age.

5. Use Games and Activities to Make Learning Fun

Board games like Monopoly or digital finance apps designed for kids can make learning about money interactive and engaging. Role-playing activities, such as running a pretend store at home, can also help them grasp real-world financial concepts in an enjoyable way.

6. Teach Them About Earning Money

Children should understand that money is earned through work. Assign small paid tasks at home, such as watering plants, organizing books, or helping with chores. This practice teaches them responsibility and the value of hard work.

7. Encourage Smart Spending Habits

Teach kids to compare prices and make wise purchasing decisions. Show them how to look for discounts, read product labels, and consider whether a purchase is truly necessary. These skills will help them become more conscious consumers in the future.

8. Introduce Banking and Online Transactions

As children grow older, introduce them to the concept of banking. Explain how savings accounts work and take them to a bank to see how money is deposited and withdrawn. Also, teach them about online transactions, digital wallets, and the importance of cybersecurity.

9. Explain the Importance of Giving and Charity

Financial literacy isn't just about earning and saving; it’s also about generosity. Encourage children to donate a small portion of their money to charity or support a cause they care about. This instills compassion and social responsibility in them.

10. Lead by Example

Children learn best by observing their parents. Demonstrate good financial habits, such as budgeting, saving, and avoiding unnecessary expenses. Talk openly about money and involve them in small financial decisions at home to reinforce their learning.

Conclusion

Teaching kids about money early in life sets the foundation for responsible financial habits. By incorporating simple, practical lessons into everyday life, parents and educators can equip children with essential money management skills. The goal is to help them become financially confident and independent adults who make smart financial choices throughout their lives.